Introduction to SIP Calculator

When it comes to investing, everyone is looking for a simple, effective way to plan and track their investments. This is where an SIP Calculator (Systematic Investment Plan) comes in handy.

Whether you’re a beginner or a seasoned investor, understanding how SIPs work and how to calculate potential returns is crucial to making informed financial decisions. In this article, we’ll walk you through what an SIP calculator is, how it works, and how to use it to maximize your investment potential.

What is SIP?

Systematic Investment Plan (SIP) is a disciplined way to invest a fixed amount in mutual funds on a regular basis. Instead of making a lump-sum investment, you invest smaller amounts over time. This strategy allows you to take advantage of rupee cost averaging — a technique that averages the cost of your investment units over time, potentially lowering the impact of market volatility.

Importance of SIP in Investment Planning

SIPs are particularly popular because they make investing easier and more accessible. They’re also incredibly beneficial for long-term wealth accumulation. By consistently investing a fixed amount, you can build a sizable portfolio over time, even with modest contributions.

Understanding SIP (Systematic Investment Plan)

How SIP Works

In an SIP, you invest a specific amount of money at regular intervals — usually monthly or quarterly — into a mutual fund of your choice. The SIP calculator helps you determine how much your investment will grow over time, based on factors like the amount invested, the expected return rate, and the duration of the investment.

For example, if you invest $100 per month in a mutual fund that delivers an average annual return of 10%, your money grows steadily over time, thanks to compounding interest.

Benefits of SIP

The major benefits of SIP include:

- Discipline: It enforces a regular investment habit.

- Compounding: Your returns earn interest on both the principal and previous interest, leading to exponential growth.

- Rupee Cost Averaging: By investing consistently, you buy more units when prices are low and fewer when prices are high.

- Affordability: It allows people to start investing with small amounts, making it easier to participate in the market.

Types of SIP

SIPs come in different forms based on your preferences:

- Fixed SIP: A set amount is invested regularly.

- Variable SIP: You can adjust the investment amount based on market conditions or your financial situation.

How to Use an SIP Calculator

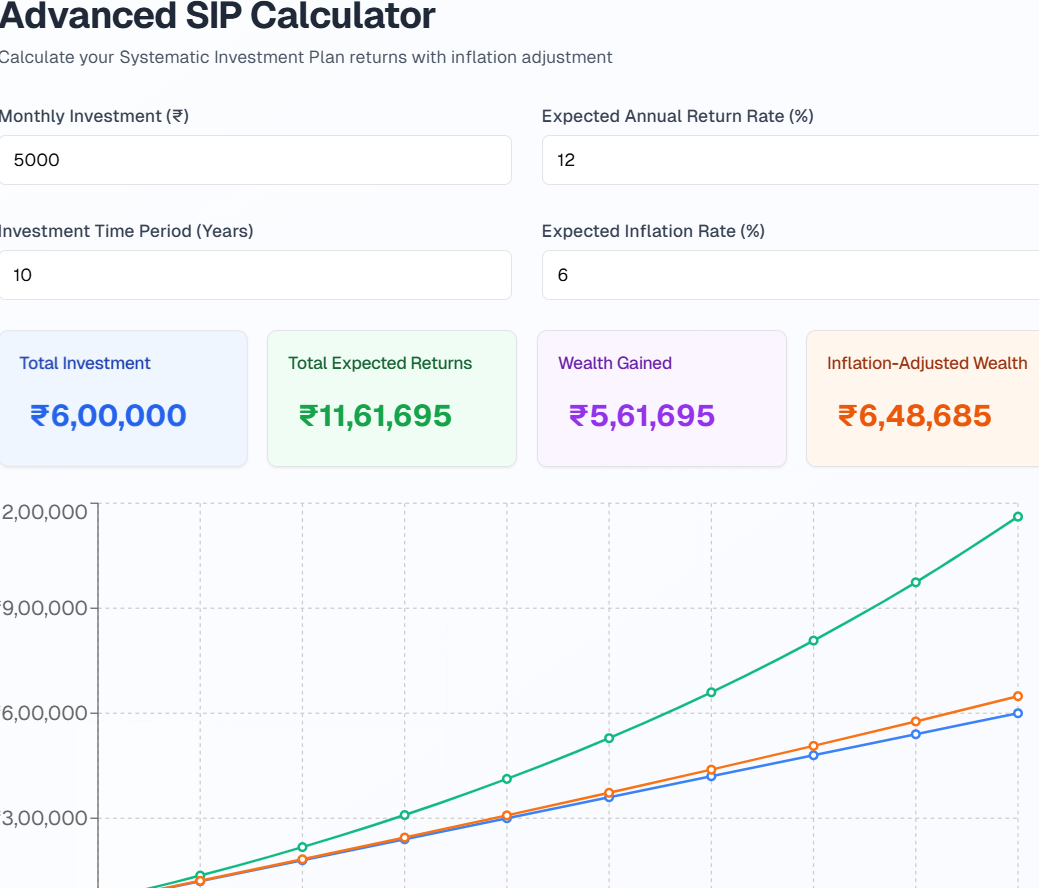

Step-by-Step Guide to Using an SIP Calculator

Using an SIP calculator is simple. Here’s how you can do it:

- Enter Investment Amount: Specify how much money you plan to invest regularly.

- Choose Investment Tenure: Decide how long you want to invest.

- Expected Return Rate: Input the expected annual return rate of the investment.

- Calculate: Click on the “Calculate” button to see an estimate of your returns.

The SIP calculator will then provide you with a detailed breakdown of how your investment will grow over time, including the total amount invested, total returns, and the final corpus value at the end of your investment period.

Example Calculation

Let’s say you invest $200 per month in a mutual fund that offers a 12% annual return for 10 years. Your SIP calculator might show:

- Total Invested: $24,000 (200 12 10)

- Estimated Returns: $46,000

- Final Corpus Value: $70,000

Key Factors to Consider in SIP

Investment Amount and Tenure

The amount you invest and the length of time you invest for have the biggest impact on your returns. The more you invest regularly, and the longer you invest, the larger your potential returns due to compounding.

Expected Returns and Risk Level

The expected return rate depends on the type of mutual fund you choose. Equity funds tend to offer higher returns but come with higher risk, while debt funds offer lower returns with less risk. It’s important to choose an SIP that matches your risk tolerance and financial goals.

Frequency of Investment

Most SIP calculators let you choose between monthly, quarterly, or even yearly investments. Monthly SIPs are the most popular, as they create a steady habit of saving and investing.

Common Mistakes to Avoid in SIP Calculations

Overestimating Returns

It’s easy to get carried away when you see high expected returns in an SIP calculator. While historical returns can give a rough idea, future returns are not guaranteed and can fluctuate due to market conditions.

Ignoring Inflation

Inflation is a silent but significant factor that erodes the value of money over time. While your SIP calculator might show high returns, the real value of your money in the future may be lower due to inflation.

Advantages of Using an SIP Calculator

Easy to Use

An SIP calculator is an easy-to-use tool that requires no technical knowledge. You just have to input your data, and the calculator does all the hard work for you.

Helps in Financial Planning

The SIP calculator helps you plan better by providing projections of your future returns. This may help you set realistic financial goals and decide how much amount to invest.

Accurate Projections

By taking into account all the factors, an SIP calculator provides a reasonably accurate estimate of how much your investment will grow, thus making it easier to make the right decisions.

SIP Calculator vs. Traditional Investment Planning

Manual Calculations vs. Automation

An SIP calculator saves time and reduces the risk of errors as compared to manual calculations of returns. Traditional methods involve complex formulas and a lot of guesswork, whereas calculators offer a clear, automated process.

Time and Effort Saved

You do not have to waste time on complex calculations by using an SIP calculator. The tool instantly gives you your expected returns, thus making the whole investment process quicker and easier.

How Accurate is an SIP Calculator?

Limitations of an SIP Calculator

While SIP calculators are very useful, they aren’t infallible. The projections they provide are based on assumptions (like constant returns) that may not always be accurate. It’s essential to use these calculators as tools for guidance rather than absolute predictions.

Role of Market Conditions

SIP calculators assume a consistent rate of return, but the market can be volatile. Although SIPs average out market fluctuations over time, returns can vary depending on economic conditions.

Advanced Features of SIP Calculators

Customizing for Different Financial Goals

Some SIP calculators enable you to customize your plan according to specific goals, such as retirement, child’s education, or buying a home. You can input your goals and get recommendations on how much to invest and for how long.

Comparing Different SIP Schemes

Advanced SIP calculators may offer the ability to compare multiple mutual fund schemes to find the best option based on your preferences for risk and return.

Popular SIP Calculators and Tools

Online SIP Calculators

Many financial websites and mutual fund platforms offer free SIP calculators. These are quick, easy-to-use tools that can help you calculate your expected returns.

Mobile App Options

If you prefer using a smartphone, there are many investment apps offering SIP calculators. These apps let you track your investments on the go.

Selecting the Best SIP Calculator for You

What to Consider

The main features to look for in an SIP calculator include the ability to customize, the possibility of comparison of different schemes, and a user-friendly design.

Comparison of Different Tools

Don’t stop at the first calculator you see. Compare other tools, read the reviews, and find one that best fits your needs.

SIP calculators prove to be valuable tools for anyone desirous of making informed investment decisions. Clarity, support in financial planning, and taking away the element of guesswork from investment calculations are some benefits of using a SIP calculator. Whether you begin your investment journey or optimize your portfolio, use of an SIP calculator saves your time, efforts, and even money.

By investing through SIPs and using the right tools, you can make your money work for you in a way that grows steadily over time. Remember, while SIP calculators are helpful, the real key to success is consistency, patience, and smart financial choices.

FAQs

What is SIP? SIP (Systematic Investment Plan) is a method of investing a fixed amount regularly in mutual funds.

How do SIP calculators work? SIP calculators estimate the possible returns of the investment based on the amount of the investment, tenor, and expected return rates.

Can a SIP calculator give accurate returns? No, SIP calculators give estimations based on history and assumptions that may not result in actual market conditions.

Is a SIP calculator free? Of course, various financial websites and apps offer SIP calculators absolutely free.

What are the variables I should assess before investing in a SIP? They include the corpus you want to invest, tenor of investing, type of mutual fund scheme, risk propensity, and so on. End.

Discover more from TechResider Submit AI Tool

Subscribe to get the latest posts sent to your email.